Netspend is a debit card that does more than just give you an easy and convenient way to withdraw money. As you will learn from this article, there are many benefits to owning a Netspend debit card.

You can transact at an ATM, banks, and retailers but what you have to look out for is the cost of withdrawing money. Many of these locations will charge you for using their services to withdraw money.

The convenience of the service might lull you into thinking that the fees are worth it. Over time, the cumulative costs of withdrawing from these locations might dampen the benefits you get from Netspend.

If you own a Netspend debit card and you want to withdraw money with it, we’ll show you where to transact and not have to pay a single cent. Do you own a debit card from another issuer such as the Bank of America and Wells Fargo? This article is for you as well.

Debit cards are popularly used to withdraw cash from an ATM. But these ATMs will charge you for using its service to transact with your card. Usually, the charges are higher if the card isn’t part of the bank’s network.

Similarly, a bank will charge you for OTC transactions. With our tips, you can use your card to withdraw money at an ATM without having to worry about fees. But first, let’s find out more about Netspend.

What Is Netspend?

Netspend is a company that develops alternative financial products and services foremost of which is the debit card. It was founded in 1999 and is presently a subsidiary of Total System Services, Inc. with principal offices in Austin, Texas, USA.

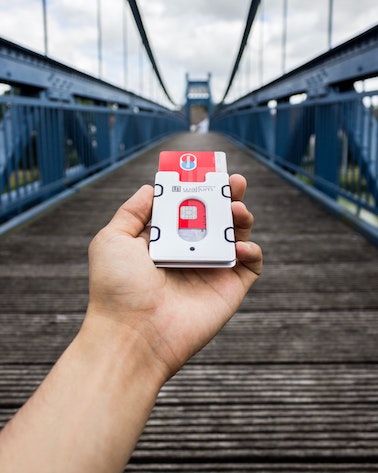

The primary business of Netspend is its debit card which is available either as Mastercard or VISA. Once you get the card, the next step is to go online and open a Netspend account.

You can keep track of your balance and monitor your transactions when the account is activated. You’ll be pleased to know that Netspend cards are covered by FDIC insurance.

What Are The Key Features Of A Netspend Card?

As we mentioned at the start of this article, there’s more to do with the Netspend card than just withdrawing cash. Here’s a few other benefits to owning a Netspend card some of which other debit cards might not offer you.

Purchase Items

Many retailers accept a Netspend debit card as a method of paying for their goods and services. These retailers include wholesalers, grocery stores, supermarkets, restaurants, and gas stations.

You can use your card to buy products online or at the brick-and-mortar store. If you’re buying online, you have to log into your account first. Make sure that your debit card details are accurately entered in the retailer’s online payment system.

The risk to shopping online is that it’s hard to know with 100% certainty the Internet connection is secure. There’s always that threat of your information getting stolen by hackers.

Thus, you might want to consider transacting at a physical store. All you have to do is to swipe your debit card at the cashiering station and the system will transmit your information from the server to the card-issuing company such as Netspend.

Transfer Money

Can you transfer money from your Netspend account to your bank account? Unfortunately, no. However, you can transfer money to friends and family who also have a Netspend debit card.

Sending funds is easy. All you need is the recipient’s account information. Likewise, it works both ways. You can receive money from a fellow Netspend cardholder or from another bank account.

To clear out any confusion, you can’t transfer funds to a bank account but your Netspend money can receive money from a bank account.

Save Money

Yes, having a Netspend debit card can help you save money. Seems counterintuitive and that’s why Netspend allows you to open a savings account where you can transfer money that you can save for a rainy day.

Netspend understands that sometimes people get lazy to save money because they have to transact with the bank and this might take a long time. With Netspend, transferring funds from one account to another is easier and faster.

Payroll Management

If you own a business, you must know that employees have their salaries at the back of their minds whenever they work. Some are worried that salaries might come in late.

This can happen if your business runs into cash flow problems. It’s already the 15th and you don’t have enough money to fund payroll. When you sign up for Netspend’s payroll management services, you’ll have fewer sleepless nights.

Netspend will take care of your payroll even when you’re experiencing cash flow problems. You can be assured that your employees will get their money on time. And if your employees consistently find themselves getting paid on schedule, they’ll perform well for your business.

Withdraw Cash From ATM

Let’s go back to withdrawing cash at an ATM using your Netspend debit card. Whenever you withdraw, Netspend will charge you US$2.50 per domestic transaction and US$4.95 if the transaction is from an international location.

And if you get declined by the ATM? Netspend will still charge you US$1 per transaction. This is how Netspend earns from its debit cards.

Where Can I Use My Netspend Card For Free?

Like we promised you, there are ways you can transact with your Netspend card without paying any charges and fees. You can save money by using your debit card at the following ATMs.

Metabank ATM

Metabank is a banking company that is linked to Netspend and manages its accounts. All you have to do is to look for a Metabank ATM that says “Who Has Privilege Status”. When you use your Netspend debit card on this type of ATM, you won’t be charged anything.

MoneyPass ATM

You can find a MoneyPass ATM by using your smartphone’s ATM locator. If there’s no Metabank ATM in the vicinity, MoneyPass ATM is a good option. This is another ATM service provider that won’t charge you for withdrawing with your Netspend debit card.

VISA Plus Alliance ATM

Netspend has an existing partnership/working arrangement with VISA Plus Alliance. All cardholders of Netspend can withdraw from their ATMs with the debit card without getting charged a fee.

Participating Retail Stores

Instead of withdrawing cash to pay for your merchandise, why not go to a retail outlet and just swipe your card? You won’t be charged fees and as an added bonus you’ll receive cash back rewards. Take note that if you withdraw cash using your Netspend card at a retailer, you’ll be charged a fee. For example, Walmart will charge you US$3.75 per withdrawal.

Money Transfers from Friends

You can also receive money from friends and family members who are part of the Netspend network. The money you receive won’t be charged any fees or be subjected to deductions.

Frequently Asked Questions (FAQs) About Netspend Debit Card

Here are some of the most commonly asked questions about the Netspend debit card answered:

How Do I Reload My Netspend Account?

There are a number of ways that you can reload or replenish your Netspend account. First, is by asking your employer to pay you by depositing directly into your Netspend account.

The same goes for government agencies. You can request that the benefits be directly deposited into your Netspend account.

Now, if your employer or the government agency prefers to deposit payments into a bank account, you can link that specific bank account to your Netspend account and facilitate money transfers.

Please take note that Netspend recognises and accepts check payments as direct deposits.

You can also replenish your account by facilitating transfers via Netspend loading centers. Lastly, you can ask friends and family members who are also Netspend account holders to deposit or transfer funds to your account.

Can My Netspend Card Be Used By Another Person?

Yes, because all you need to transact using the Netspend card is the PIN and the card number. You have to be very careful with your card. Don’t share the PIN with anyone or keep a hard copy within your person.

Anyone who has your PIN can access your account and run any transaction. Since these transactions are entered using your PIN and card number, they will be approved.

I Just Lost My Netspend Card. What Should I Do First?

Report the incident by going online and logging into your Netspend account. You can also contact customer support and leave a record of the incident. Once you report the incident, Netspend will immediately suspend your account.

Conclusion

Netspend is a good debit card to have because its benefits go beyond withdrawing cash from an ATM. You can pay for purchases, send/receive money to friends, manage your business’ payroll, and Netspend makes it easier for you to save money.

However, like other card-type payment methods, take extra care in how and where you store it. If you lose your Netspend card report the incident right away to keep the situation from getting worse.